Daily Summary

Weakness in the Software Tech Space

With last week’s market action, the technology sector continues to stand out as one of the hardest-hit areas. Since the end of last month, technology has fallen from first to fourth in our DALI relative sector rankings, underscoring a meaningful deterioration in its technical picture.

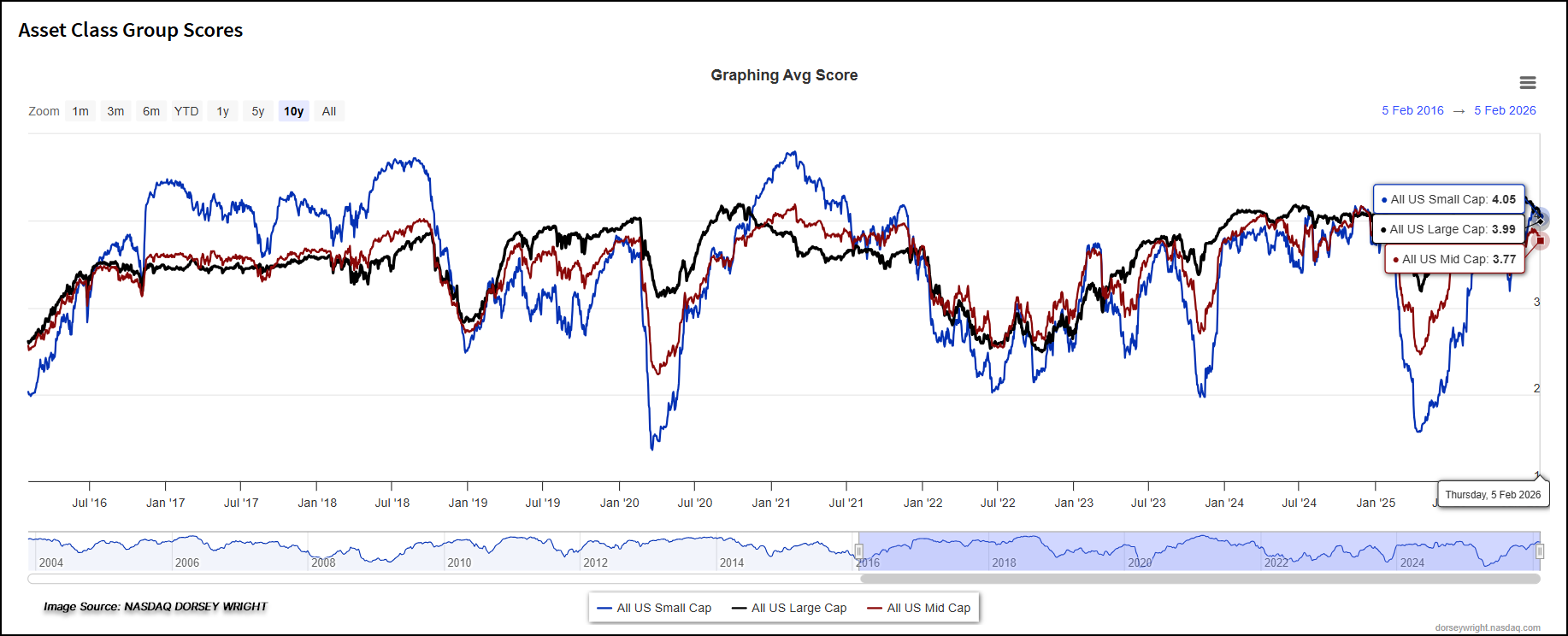

Asset Class Group Score: Shifting Size and Style Leadership

The continued outperformance by small caps during the near-term has brought about notable changes in near-term relative strength, leading to developments within the U.S. Size and Style groups on the Asset Class Group Scores page.

Weekly Video

Weekly Rundown Video – Feb 4, 2026

Weekly rundown with NDW analyst team covering all major asset classes.

Weekly rundown with NDW analyst team covering all major asset classes.

Beginners Series Webinar: Join us on Monday, February 9th at 2 PM (ET) for our NDW Beginners Series Webinar. This week's topic is: Fund Score Composition and the Asset Class Group Scores Page Register Here

With last week’s market action, the technology sector continues to stand out as one of the hardest-hit areas. Since the end of last month, technology has fallen from first to fourth in our DALI relative sector rankings, underscoring a meaningful deterioration in its technical picture. The broader technology space is composed of four NDW sub-sectors—Software, Semiconductors, Computers, and Internet—and understanding the relative strength within these groups is essential. Identifying which areas of tech are weakening helps guide underweights, while recognizing which areas remain resilient supports more targeted overweight exposure as the sector undergoes rotation.

Over the past week, the iShares North American Software ETF (IGV), a proxy for the software space, declined more than 10%. The fund is now down over 20% year‑to‑date and carries a fund score of 1.18 with a sharp negative score direction of –4.44. IGV holds roughly 112 software names, and the weakness is broad-based rather than concentrated.

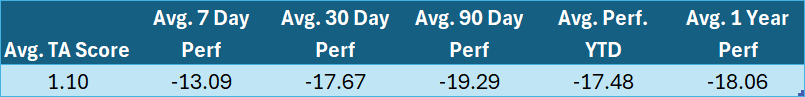

As shown in the chart, the average constituent has a Technical Attribute (TA) score of just 1.1, highlighting the weakness through the software space. Performance metrics at various intervals also show that the average stock is down 19.29% year‑to‑date and 13.09% in the last seven days alone. This degree of downside suggests that the downturn is sector-wide rather than driven by a handful of names.

IGV’s 30% pullback, beginning at the end of 2025, marks the 17th instance of a +20% decline. Historical pullbacks following similar drawdowns offer helpful context:

- Peak-to-trough declines of 20% or more have averaged a loss of ~35%.

- After the initial 20% pullback, IGV typically falls an additional 17.78% before bottoming.

- The average peak‑to‑trough duration is approximately 121 days.

- Once a 20% decline occurs, troughs are historically reached in around 40 days.

- On average, IGV experiences a 10% drawdown roughly once every 590 days.

Takeaway: Even with the pullback, history shows that software pullbacks rarely stop at the first leg down. The software space remains under pressure, and you should be prepared for continued volatility as IGV continues to move lower. As you remain invested in technology, you can continue to overweight other sub-technology sectors that are still showing strength.

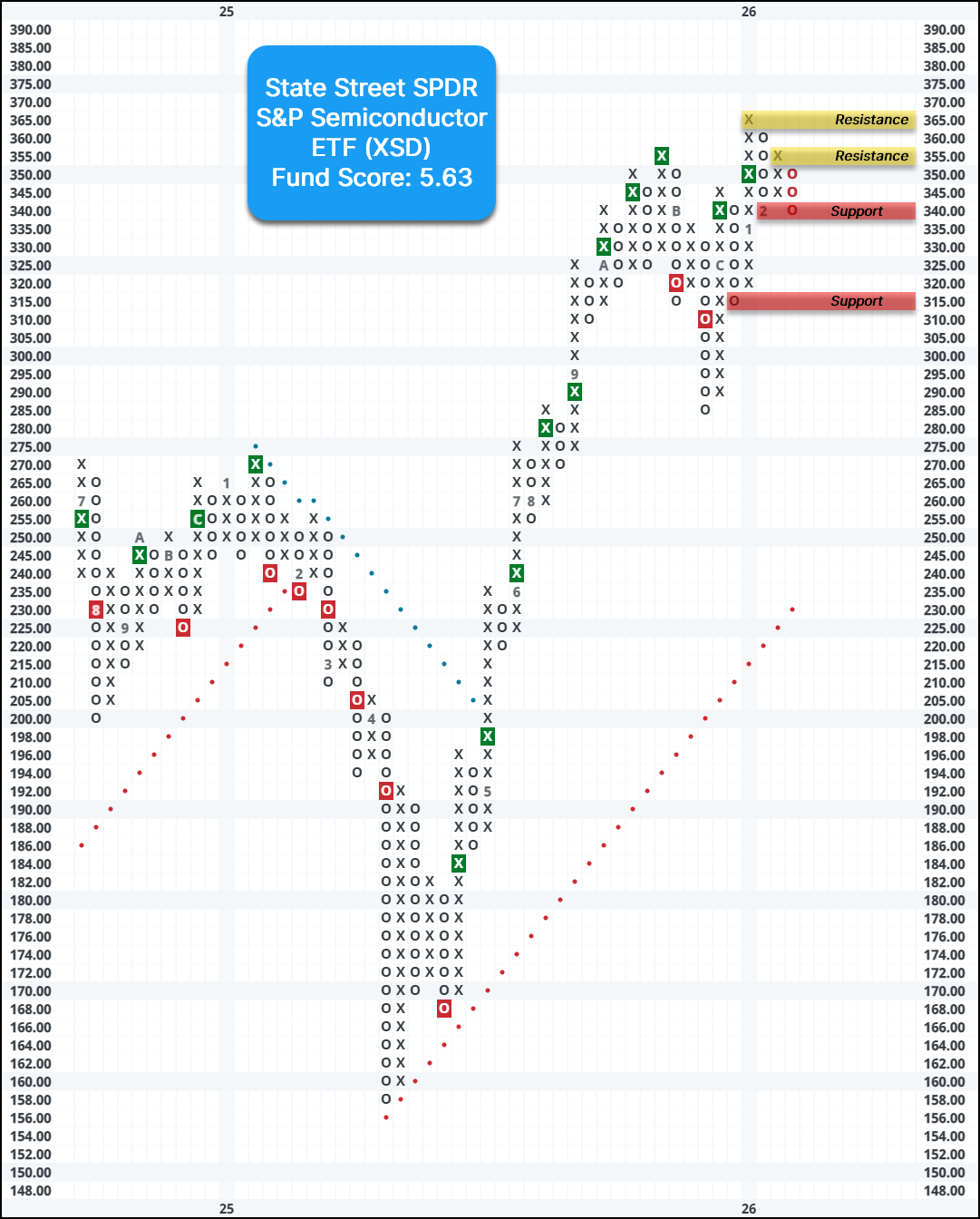

The State Street SPDR S&P Semiconductor ETF (XSD) provides exposure to names in the semiconductor space. Unlike several other semiconductor ETFs, XSD is less top heavy, with the top position only holding a weight of ~3.3%. XSD reversed back into Xs against the market in December of last year and holds a fund score of 5.63 with a score direction of 1.03. Year-to-date, the fund is up ~9%, building on its 29% gain in 2025. Additionally, XSD sits on two consecutive buy signals after completing a double top break at $350. Long exposure can be considered here, given the normalization of the 10-week trading band. Initial support can be seen at $340, with additional support at $315. Resistance can be seen at $355 and $365.

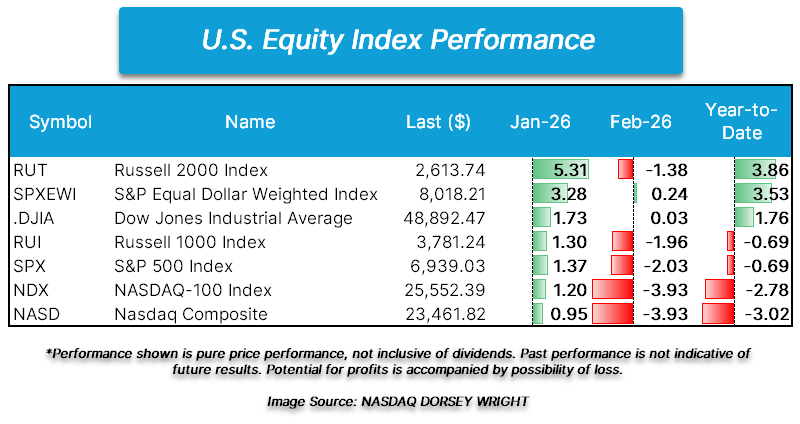

After kicking off 2026 on a hot note with a gain north of 5% in January, small caps, by way of the Russell 2000 Index (RUT), have fallen 1.38% during February’s first week of trading (thru 2/5). Although starting February lower, RUT is still outperforming large cap indices like the S&P 500 (SPX) (fallen 2% in February), Nasdaq-100 (NDX), and Nasdaq Composite (NASD) (both down 3% in February). The continued outperformance by small caps during the near-term has brought about notable changes in near-term relative strength, leading to developments within the U.S. Size and Style groups on the Asset Class Group Scores page.

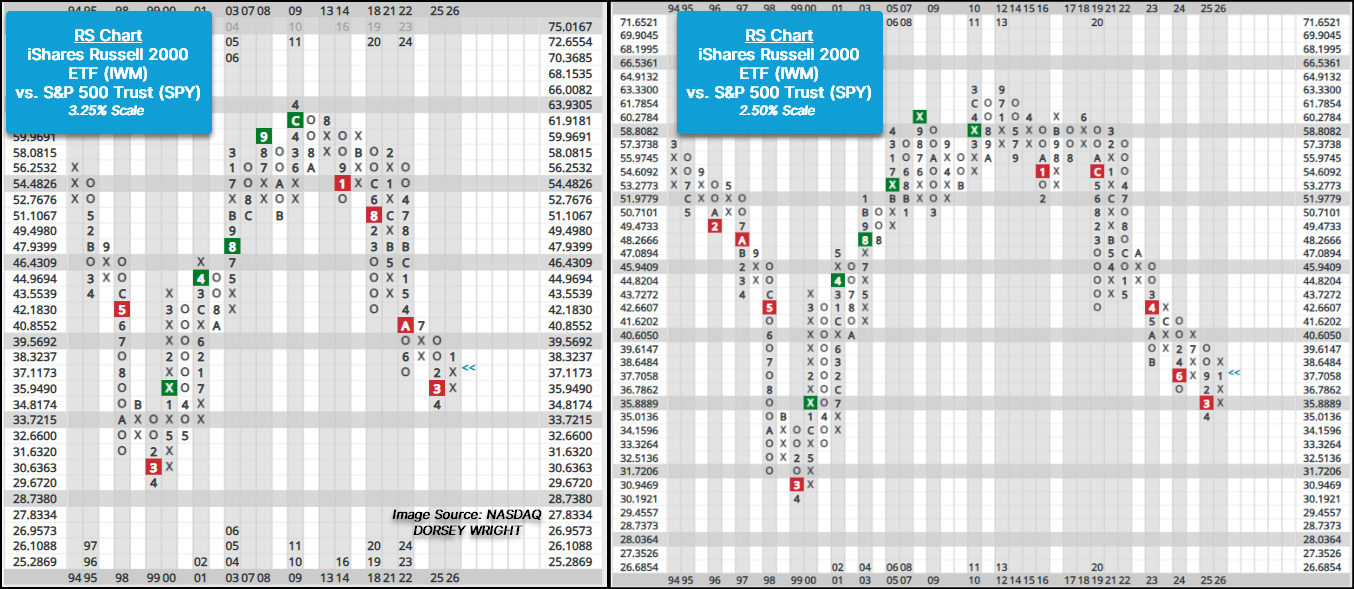

A prime example of the recent positive near-term relative strength by small caps can be seen on the two RS charts between the iShares Russell 2000 ETF (IWM) versus the S&P 500 Trust (SPY) below. On both the longer-term 3.25% and the 2.5% scale RS charts, action in mid-January brought the charts into Xs, signaling near-term outperformance by small caps for the first time since both charts reversed into Os in the latter part of 2024.

While a positive development for small caps in the near-term, many seasoned investors and advisors have witnessed near-term surges in small caps that have failed to develop into a long-term trend of outperformance, such as the one that has been exhibited by large caps for much of the last decade. In the case of the two RS charts below, IWM has been on a relative strength sell signal in the long-term since January 2016.

Though the long-term relative strength view shows favoritism to large caps, the Asset Class Group Scores page has highlighted periods in which small and mid caps have seen near-term trending and RS characteristics compete with and better large caps. The line chart below shows the past ten years of group score history for the All US Large, Mid, and Small Cap groups. This week’s action brought All US Small Cap back above All US Large Cap for the first time since the latter part of 2024. For much of 2024 though, small caps were in the sidecar, along for the ride as large caps rallied and provided brief periods of assistance when large caps briefly faltered. The last material period in which large caps scored below their small and mid cap counterparts on the Asset Class Group Scores page was from late 2020 to late 2021. Not only does the chart highlight the ebbs and flows of the market, but it also tells a story of periods in which investors have had to adapt their allocations. Those who have adapted their allocations over the years have changed core or size and style exposure to a more equally weighted approach rather than entirely focused or overweight large caps.

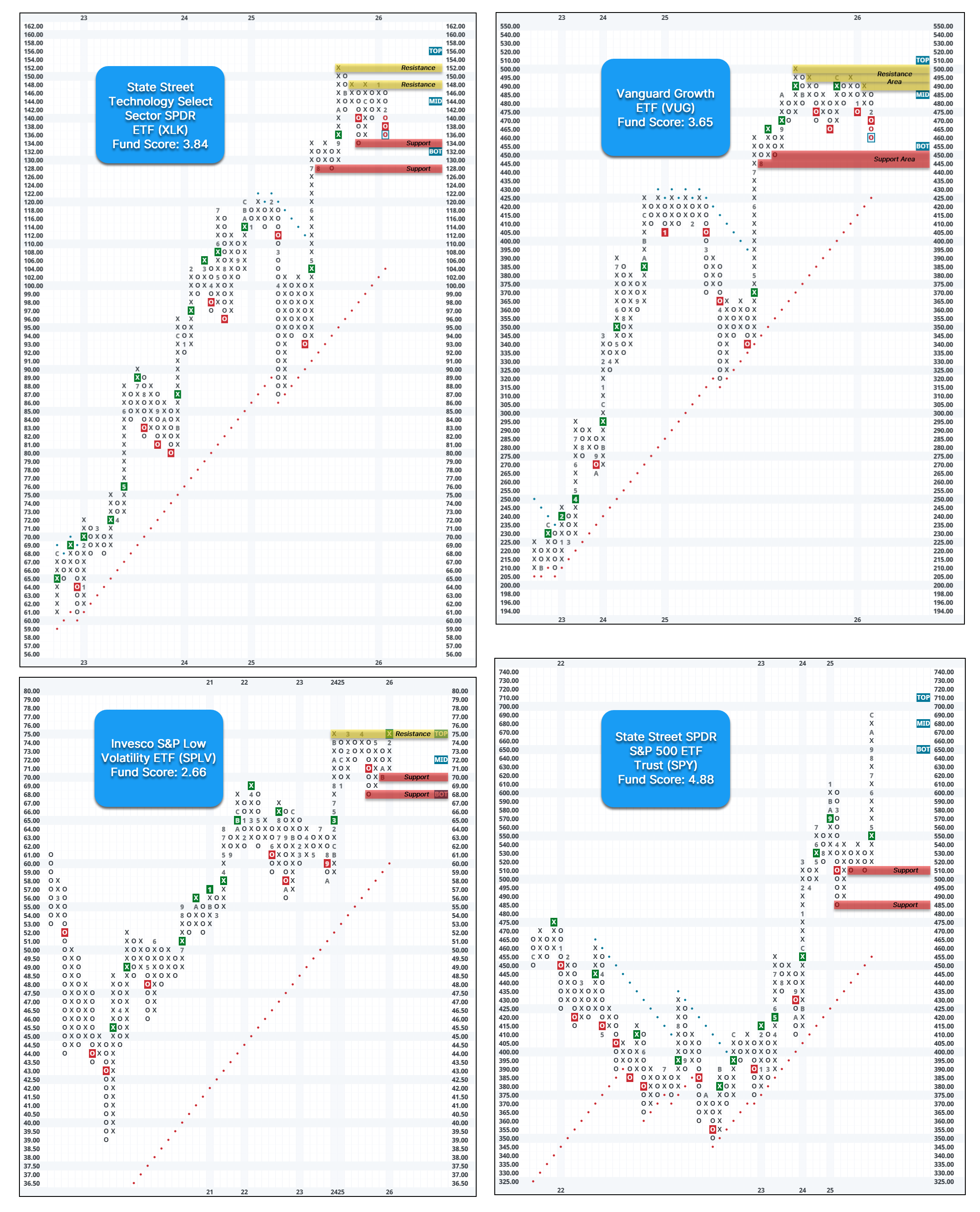

Further evidence of recent developments within large, mid, and small caps can be seen through the U.S. Style View on the Asset Class Group Scores page. Since the end of 2025, Large Cap Value and Blend have fallen below the 4 score threshold, while Small and Mid Cap Value along with Small Cap Blend have seen their group scores rise above 4. The Size and Style snapshots below also highlight developments within the value and growth relationship as well. Notably, all three growth groups are the lowest scoring above the nine size and style groups, while all three value groups score above 4. This highlights that leadership within the small cap rallying has been primarily from the value camp and sectors like energy and staples (as noted in prior reports).

Monitoring shifts in group scores for U.S. Size and Style groups can help adapt allocations in the short-to-intermediate term as well as see the first inkling of changes to leadership due to the more sensitive nature of the fund scoring system. One way to monitor shifts in group score leadership is through the Group Scores Action widget on the Dashboard page. If this widget does not appear on your Dashboard page, it can be added by selecting the blue “+ Widget” in the upper right-hand corner of the Dashboard page.

Featured Charts:

Portfolio View - Major Market ETFs

| Symbol | Name | Price | Yield | PnF Trend | RS Signal | RS Col. | Fund Score | 200 Day MA | Weekly Mom |

|---|---|---|---|---|---|---|---|---|---|

| DIA | SPDR Dow Jones Industrial Average ETF Trust | 488.91 | 1.41 | Positive | Sell | X | 4.07 | 455.38 | - 4W |

| EEM | iShares MSCI Emerging Markets ETF | 58.53 | 2.05 | Positive | Buy | X | 5.51 | 51.50 | + 6W |

| EFA | iShares MSCI EAFE ETF | 100.33 | 3.22 | Positive | Sell | X | 4.47 | 92.36 | + 7W |

| IJH | iShares S&P MidCap 400 Index Fund | 69.53 | 1.30 | Positive | Buy | O | 4.20 | 64.20 | + 10W |

| IJR | iShares S&P SmallCap 600 Index Fund | 128.43 | 1.36 | Positive | Sell | O | 3.20 | 115.59 | + 10W |

| QQQ | Invesco QQQ Trust | 597.03 | 0.45 | Positive | Buy | O | 3.90 | 576.93 | - 6W |

| RSP | Invesco S&P 500 Equal Weight ETF | 198.56 | 1.58 | Positive | Sell | O | 3.19 | 186.24 | + 10W |

| SPY | State Street SPDR S&P 500 ETF Trust | 677.62 | 1.05 | Positive | Buy | X | 4.76 | 644.32 | - 6W |

| XLG | Invesco S&P 500 Top 50 ETF | 57.29 | 0.64 | Positive | Buy | X | 4.77 | 55.06 | - 6W |

Average Level

11.49

| < - -100 | -100 - -80 | -80 - -60 | -60 - -40 | -40 - -20 | -20 - 0 | 0 - 20 | 20 - 40 | 40 - 60 | 60 - 80 | 80 - 100 | 100 - > |

|---|---|---|---|---|---|---|---|---|---|---|---|

| < - -100 | -100 - -80 | -80 - -60 | -60 - -40 | -40 - -20 | -20 - 0 | 0 - 20 | 20 - 40 | 40 - 60 | 60 - 80 | 80 - 100 | 100 - > |

| AGG | iShares US Core Bond ETF |

| USO | United States Oil Fund |

| DIA | SPDR Dow Jones Industrial Average ETF |

| DVY | iShares Dow Jones Select Dividend Index ETF |

| DX/Y | NYCE U.S.Dollar Index Spot |

| EFA | iShares MSCI EAFE ETF |

| FXE | Invesco CurrencyShares Euro Trust |

| GLD | SPDR Gold Trust |

| GSG | iShares S&P GSCI Commodity-Indexed Trust |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF |

| ICF | iShares Cohen & Steers Realty ETF |

| IEF | iShares Barclays 7-10 Yr. Tres. Bond ETF |

| LQD | iShares iBoxx $ Investment Grade Corp. Bond ETF |

| IJH | iShares S&P 400 MidCap Index Fund |

| ONEQ | Fidelity Nasdaq Composite Index Track |

| QQQ | Invesco QQQ Trust |

| RSP | Invesco S&P 500 Equal Weight ETF |

| IWM | iShares Russell 2000 Index ETF |

| SHY | iShares Barclays 1-3 Year Tres. Bond ETF |

| IJR | iShares S&P 600 SmallCap Index Fund |

| SPY | SPDR S&P 500 Index ETF Trust |

| TLT | iShares Barclays 20+ Year Treasury Bond ETF |

| GCC | WisdomTree Continuous Commodity Index Fund |

| VOOG | Vanguard S&P 500 Growth ETF |

| VOOV | Vanguard S&P 500 Value ETF |

| EEM | iShares MSCI Emerging Markets ETF |

| XLG | Invesco S&P 500 Top 50 ETF |

Long Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| BCO | The Brink's Company | Protection Safety Equipment | $128.21 | mid 110s - low 120s | 152 | 104 | 5 for 5'er, top half of PROT sector matrix, LT pos peer & mkt RS, spread triple top, R-R>2.0, Earn. 2/25 |

| WFC | Wells Fargo & Company | Banks | $92.01 | mid 80s - low 90s | 128 | 76 | 5 for 5'er, top 25% of BANK sector matrix, LT pos peer & mkt RS, buy on pullback, R-R~3.0 |

| JPM | J.P. Morgan Chase & Co. | Banks | $310.16 | lo 300s - mid 320s | 380 | 256 | 5 TA rating, top 25% of favored BANK sector matrix, LT RS buy, LT pos trend, buy-on-pullback |

| ENVA | Enova International Inc | Finance | $159.78 | hi 150s - 160s | 190 | 142 | 5 for 5'er, 2 of 78 in FINA sector matrix, LT pos peer & mkt RS |

| EWBC | East West Bancorp, Inc. | Banks | $118.46 | mid 100s - mid 110s | 157 | 92 | 4 for 5'er, top third of favored BANK sector matrix, LT pos peer RS, one box from mkt RS buy, spread quad top |

| ULTA | Ulta Beauty, Inc. | Retailing | $677.91 | 632 - hi 600s | 840 | 568 | 4 TA rating, top 10% of RETA sector matrix, LT RS buy, consec buy signals |

| APTV | Aptiv PLC | Autos and Parts | $79.72 | hi 70s - low 80s | 100 | 69 | 5 for 5'er, top half of AUTO sector matrix, successful trend line test |

| GS | Goldman Sachs Group, Inc. | Wall Street | $890.41 | mid-800s - mid-900s | 1416 | 736 | 5 TA rating, top 10% of WALL sector matrix, LT RS buy, LT pos trend, buy-on-pullback |

| PHM | PulteGroup, Inc. | Building | $134.05 | hi 120s - mid 130s | 168 | 110 | 4 for 5'er, top half of BUIL sector matrix, LT pos peer & mkt RS, bullish catapult |

Short Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|

Removed Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| LAMR | Lamar Advertising Company | Media | $131.13 | 120s - low 130s | 158 | 110 | Removed for earnings. Earn 2/20 |

Follow-Up Comments

| Comment | |||||||

|---|---|---|---|---|---|---|---|

|

|

|||||||

NDW Spotlight Stock

PHM PulteGroup, Inc. R ($135.01) - Building - PHM is a 4 for 5'er that ranks in the top half of the building sector matrix and has been on market and peer RS buy signals since 2023 and 2024, respectively. On its default chart, PHM gave a second consecutive buy signal in Friday's trading when it completed a bullish catapult at $136. Long exposure may be added in the upper $120s to mid $130s and we will set our initial stop at $110, which would take out multiple levels of support on PHM's chart. We will use the bullish price objective, $168, as our target price.

| 26 | |||||||||||||||||||||||||||||

| 142.00 | X | • | 142.00 | ||||||||||||||||||||||||||

| 140.00 | X | O | • | • | 140.00 | ||||||||||||||||||||||||

| 138.00 | X | O | X | • | X | • | 138.00 | ||||||||||||||||||||||

| 136.00 | X | O | X | O | A | O | • | 136.00 | |||||||||||||||||||||

| 134.00 | 9 | O | X | O | X | O | • | X | X | 134.00 | |||||||||||||||||||

| 132.00 | X | O | O | X | O | • | X | O | X | 132.00 | |||||||||||||||||||

| 130.00 | X | X | O | O | • | X | X | X | O | 2 | 130.00 | ||||||||||||||||||

| 128.00 | X | O | X | O | • | C | O | X | O | X | O | X | 128.00 | ||||||||||||||||

| 126.00 | X | O | X | O | X | • | X | O | X | O | X | O | X | 126.00 | |||||||||||||||

| 124.00 | X | O | O | X | O | X | O | O | 1 | O | Mid | 124.00 | |||||||||||||||||

| 122.00 | X | X | O | X | O | X | B | X | O | X | • | 122.00 | |||||||||||||||||

| 120.00 | X | O | X | O | O | X | O | X | O | X | O | X | • | 120.00 | |||||||||||||||

| 118.00 | X | O | 8 | O | X | O | X | O | X | O | • | 118.00 | |||||||||||||||||

| 116.00 | X | X | O | X | • | O | O | O | X | • | • | 116.00 | |||||||||||||||||

| 114.00 | X | O | X | O | X | • | O | X | • | 114.00 | |||||||||||||||||||

| 112.00 | X | O | X | O | • | O | • | 112.00 | |||||||||||||||||||||

| 110.00 | X | O | X | • | • | 110.00 | |||||||||||||||||||||||

| 108.00 | 7 | O | • | 108.00 | |||||||||||||||||||||||||

| 106.00 | • | X | • | Bot | 106.00 | ||||||||||||||||||||||||

| 104.00 | O | X | • | 104.00 | |||||||||||||||||||||||||

| 102.00 | O | X | • | 102.00 | |||||||||||||||||||||||||

| 100.00 | O | X | • | 100.00 | |||||||||||||||||||||||||

| 99.00 | O | • | 99.00 | ||||||||||||||||||||||||||

| 26 |

| DAL Delta Air Lines Inc. ($75.22) - Aerospace Airline - DAL broke a triple top at $72 to return to a buy signal as shares rallied to $75, marking a new all-time chart high. The stock is a 4 for 5'er that ranks within the top half of the Aerospace Airline sector matrix. Okay to consider here on the breakout or on a pullback toward the middle of the 10-week trading band in the upper $60s. Initial support lies in the $64 to $65 range, while additional can be found at $56. |

| MMM 3M Company ($172.65) - Chemicals - MMM retuned to a buy signal and a positive trend Friday when it broke a double top at $166 and continued higher to $172, where it now sits against resistance. The outlook for the stock remains unfavorable, however, as even with the positive trend change MMM is a 2 for 5'er. |

| UAL United Airlines Holdings Inc. ($116.12) - Aerospace Airline - UAL reversed into Xs and broke a double top at $114 to return to a buy signal as shares rallied to $116. The stock has been at least a 3 for 5'er since May 2023 and currently maintains a 4 TA rating. Okay to consider here on the breakout or on a pullback to the middle of the 10-week trading at $108. Initial support lies at $106, while additional can be found at $102 and $97, the bullish support line. |

Daily Option Ideas for February 6, 2026

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| Aptiv PLC - $82.38 | O: 26E82.50D15 | Buy the May 82.50 calls at 7.10 | 74.00 |

Follow Ups

| Name | Option | Action |

|---|---|---|

| Gilead Sciences, Inc. ( GILD) | Mar. 125.00 Calls | Raise the option stop loss to 25.00 (CP: 27.00) |

| Cisco Systems, Inc. ( CSCO) | Mar. 77.50 Calls | Raise the option stop loss to 6.30 (CP: 8.30) |

| CME Group, Inc. ( CME) | Mar. 270.00 Calls | Raise the option stop loss to 28.90 (CP: 30.90) |

| Wells Fargo & Company ( WFC) | Apr. 87.50 Calls | Raise the option stop loss to 7.35 (CP: 9.35) |

| Walmart Inc. ( WMT) | Apr. 115.00 Calls | Raise the option stop loss to 16.20 (CP: 18.20) |

| Bank of America ( BAC) | Apr. 52.50 Calls | Raise the option stop loss to 3.25 (CP: 5.25) |

| Hilton Worldwide Holdings Inc ( HLT) | Mar. 300.00 Calls | Raise the option stop loss to 17.90 (CP: 19.90) |

| Citigroup, Inc. ( C) | May. 120.00 Calls | Initiate an option stop loss of 7.40 (CP: 9.40) |

| NVIDIA Corporation ( NVDA) | Mar. 180.00 Calls | Initiate an option stop loss of 13.70 (CP: 15.70) |

| GE Aerospace ( GE) | May. 310.00 Calls | Raise the option stop loss to 26.90 (CP: 28.90) |

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| Cal-Maine Foods, Inc. - $82.53 | O: 26Q85.00D15 | Buy the May 85.00 puts at 7.10 | 90.00 |

Follow Up

| Name | Option | Action |

|---|---|---|

| Paypal Holdings Inc ( PYPL) | Mar. 60.00 Puts | Raise the option stop loss to 17.40 (CP: 19.40) |

| Dominion Energy Inc. ( D) | Apr. 57.50 Puts | Stopped at 63.00 (CP: 62.27) |

| Marvell Technology Inc. ( MRVL) | Mar. 80.00 Puts | Stopped at 8.20 (CP: 6.55) |

| 3M Company ( MMM) | Apr. 155.00 Puts | Stopped at 166.00 (CP: 172.67) |

New Recommendations

| Name | Option Sym. | Call to Sell | Call Price | Investment for 500 Shares | Annual Called Rtn. | Annual Static Rtn. | Downside Protection |

|---|---|---|---|---|---|---|---|

| Intel Corporation $ 48.24 | O: 26C52.50D20 | Mar. 52.50 | 3.50 | $ 23,860.90 | 77.79% | 53.87% | 5.84% |

Still Recommended

| Name | Action |

|---|---|

| Alcoa Inc. ( AA) - 56.38 | Sell the March 60.00 Calls. |

| Intel Corporation ( INTC) - 48.24 | Sell the May 49.00 Calls. |

| The Gap, Inc. ( GAP) - 28.20 | Sell the March 29.00 Calls. |

| Brinker International Inc ( EAT) - 160.64 | Sell the April 165.00 Calls. |

| Dollar General Corp. ( DG) - 144.90 | Sell the May 150.00 Calls. |

The Following Covered Write are no longer recommended

| Name | Covered Write |

|---|---|

|

|

|