There are changes to both the First Trust Sector (FTRUST) and Income (FTINCOME) Models this week.

First Trust Sector Model

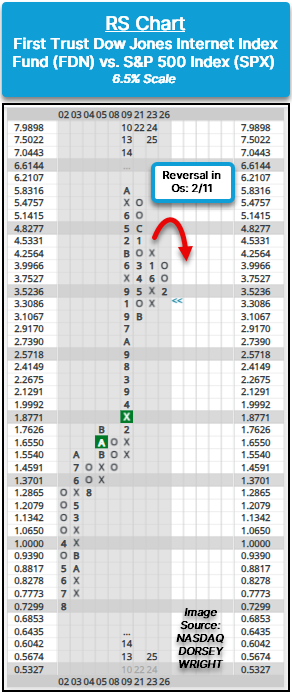

The change to the First Trust Sector Model (FTRUST) this week involves a removal of one fund and addition of two others to the model. Recall the First Trust Sector Model utilizes an RS versus benchmark methodology, as opposed to an RS matrix of the model’s full ETF lineup. The First Trust Sector Model’s process compares each of the funds in the model’s universe to the S&P 500 Index (SPX) on a 6.5% scale RS chart. If the RS chart resides in a column of Xs, the ETF is included in the model’s holdings, while an RS chart residing in a column of Os warrants the fund’s exclusion.

Following Wednesday’s (2/11) action, the RS chart comparing the First Trust Dow Jones Internet Index Fund (FDN) to SPX reversed into a column of Os after having been in Xs since June 2023. This decreases the model’s allocation to technology exposure, leaving Semiconductors (FTXL) as the remaining technology-related fund. While the model’s technology exposure has decreased, the new additions to the First Trust Sector Model (FTRUST) bring about an overweight to energy.

Following Friday’s (2/13) action, both RS charts comparing First Trust Energy AlphaDEX Fund ([FXN) and First Trust Natural Gas ETF ([FCG]) to SPX reversed into a column of Xs after having been in Os since February 2023. FXN has a high fund score of 4.26 with the fund maintaining a buy signal since May 2025 and positive trend since June last year on the default point and figure chart. More recent action has brought the fund above $19.50, a 52-week chart high. Meanwhile, FCG has an acceptable fund score of 3.48 with the fund maintaining a buy signal since December 2025 and positive trend since June last year on the default point and figure chart. More recent action has brought the fund above $26.50, a 52-week chart high.

With the one removal and two additions, the First Trust Sector Model will rebalance with ten holdings to equally weight at 10% and now maintains an overweight toward energy and healthcare.

First Trust Income Model

The change to the First Trust Income Model involves the removal of the First Trust Nasdaq Technology Dividend Index Fund (TDIV), which fell below the sell threshold within the Model’s relative strength matrix rankings, and the addition of the First Trust Morningstar Dividend Leaders Index Fund (FDL). On the default point and figure trend chart, FGD has maintained a buy signal since April of last year and a positive trend since January 2024. Since reversing back into Xs on the trend chart in November of last year, FDL has rallied from the lower $40s to a new high at $51. Last week’s action brought the market RS chart against the S&P 500 Equal Weight Index (SPXEWI) back into Xs, indicating positive near-term relative strength. FDL maintains a fund score of 4.58, which is higher than the average score for a fund within the Growth & Income (4.24) group on the Asset Class Group Scores page.

With the change, the First Trust Income Model will rebalance the five holdings to equally weighted at 20%, while maintaining exposure to Energy Infrastructure (EMLP), Stoxx European Div. (FDD), Utilities (FXU), Global Div. (FGD), and Morningstar Div. (FDL) funds.